Wuhan Iron and Steel Group’s Resource Integration Project

Issue Time:2015-03-19 Source:CEA Author:CEA

The

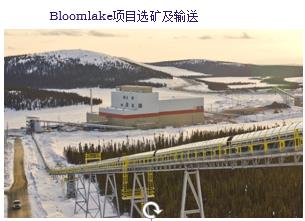

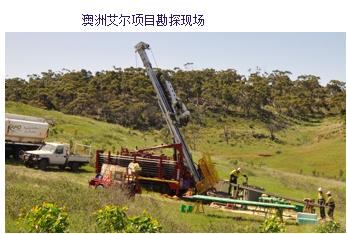

specific information of the project: Wuhan Iron and Steel (Group) Company (WISCO)

intends to transfer 100% shares of its 4 subsidiaries i.e. WISCO Mining Co.,

Ltd., WISCO International Resources Development & Investment Co., Ltd.,

WISCO Brazil Metallurgical Investment Co., and WISCO Iron and Steel (Australia)

Ltd., to the Wuhan Iron and Steel Co., Ltd., a listed company.

This

resource integration project involves four legal entities, of which, three are

located outside the country, and of the fourth company, half of its assets are

treated as overseas assets and equity, specifically they are spread in

Australia (South Australia, Western Australia), Canada (Quebec, Ontario),

Liberia (State of Bong), and Brazil (Rio de Janeiro). The types of companies

involved in vary from listed companies (listed in Canada, Australia and

Brazil), to limited liability company, and unincorporated joint venture (CJV).

And, the company’s asset types also involve real options and various forms of

rights of return, in addition to the conventional assets.